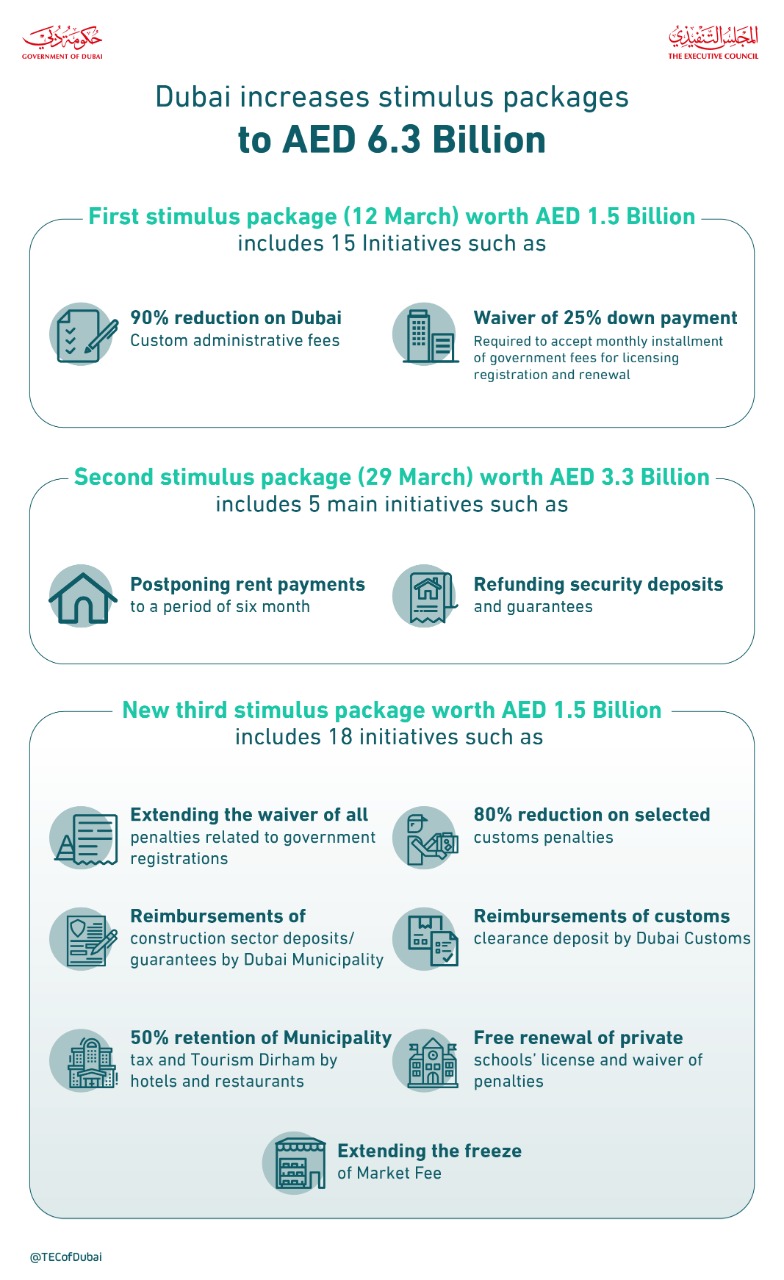

- Total value of economic incentives introduced by the Dubai govt in the past few months rises to AED6.3 billion

Under the directives of Vice President and Prime Minister of the UAE and Ruler of Dubai His Highness Sheikh Mohammed bin Rashid Al Maktoum, Dubai has launched its third stimulus package to ease the impact of the COVID-19 crisis on businesses. Worth AED1.5 billion, the new package raises the value of business incentives introduced by the emirate’s government in the past few months to AED6.3 billion. The first stimulus package announced by the Dubai government was worth AED1.5 billion while the second was worth AED3.3 billion.

Crown Prince and Chairman of The Executive Council of Dubai His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum emphasised the Government of Dubai’s commitment to continue supporting all economic sectors in overcoming the repercussions of the COVID-19 pandemic.

“Our economy is strong, has a stable foundation and has shown high resilience to crises, all of which enable us to effectively navigate any global challenge. We stand together with the private sector to overcome the impact of the pandemic. We are keen to help businesses renew their growth momentum as soon as possible,” HH Sheikh Hamdan bin Mohammed said.

The Crown Prince’s remarks came as he approved the third economic stimulus package launched by the Dubai government to support the recovery of sectors across the economy and mitigate the financial pressures faced by businesses. The stimulus package aims to support small and medium enterprises and a number of strategic sectors maintain business continuity by reducing operational costs.

HH Sheikh Hamdan pointed out that investors and entrepreneurs should keep pace with changing global markets, continue to explore new opportunities, and ensure they are prepared for the future. He stressed that the SME sector represents a key pillar of the national economy and plays a major role in helping Dubai maintain its status as a global destination for entrepreneurs and start-ups.

“SMEs constitute a highly strategic sector and are a major contributor to the emirate's GDP. Supporting this sector in tiding over the current challenges is vital to accelerate our progress towards a diversified knowledge-based economy,” HH Sheikh Hamdan added.

SMEs account for 99% of all companies operating in Dubai, 46% of the GDP and 51% of the emirate's workforce.

New initiatives

The government has launched many initiatives to support business sectors across the economy. In the healthcare sector, the government has taken steps to ensure its payments to private hospitals are expedited. In the tourism and entertainment sector, an initiative to refund hotel establishments and restaurants 50% of the 7% municipality fees charged on sales will be extended for the period from July to December 2020. In addition, the ‘Tourism Dirham Fee’ has been halved until the end of the year.

In the international trade sector, fines for some customs cases will be reduced by 80%, with the option to pay them in instalments, to help traders meet their financial obligations and boost business continuity.

In the construction sector, payment of financial dues to contractors will be expedited and all financial guarantees for construction activities related to commercial licences will be refunded. This will be replaced by another system that guarantees all the rights of the contracting parties.

In the education sector, private schools will be exempted from commercial and educational license renewal fees until the end of the year.

The temporary entry permits obtained by art exhibitions for artworks loaned from institutionoutside Dubai will be extended until the end of 2020. These include artworks that have entered Dubai in the fourth quarter of 2019 and have since remained in the emirate.

Extension of some initiatives from the first package

The current stimulus package extends the validity of some of the initiatives announced in the first stimulus package for an additional three months until the end of September 2020 as part of support extended to the private sector in recovering from the crisis. These include the freeze on the 2.5% market fee, cancellation of all fines charged for late payment of government service fees (such as accumulated fines charged for delays in renewing business licenses). Payment of penalties will not be required to renew commercial licenses during this period.

Furthermore, commercial licenses can be renewed without the mandatory renewal of lease contracts. The 25% down payment requirement for paying government fees in instalments will also be cancelled. In addition, businesses are exempted from fees for sales and special offers.

In the international trade sector, exemptions for traditional commercial vessels registered locally in the UAE from docking fees at Dubai Port and Hamriya Port (include direct and indirect loading fees) will be extended.

The AED50,000 bank or cash guarantee required to conduct customs clearance activity will continue to be waived, and bank and cash guarantees paid by customs clearance companies will be refunded. Also, the fees on customs documents will continue to be reduced from AED50 to AED5 for each transaction, and processing of customs complaints will be accelerated.

In the tourism, entertainment and events sector, the freeze on fees charged for hotel rating, ticket sales, issuing permits and other government fees related to entertainment and business events has been extended.

For an optimal experience please

For an optimal experience please